Learn why optimising your ERP system after go-live is essential for continuing to achieve better business outcomes.

Implementing an ERP solution is a forward-thinking move. It helps to digitalise and transform the way your organisation operates, so you can embrace new business models and better meet customer needs in a rapidly changing, global marketplace.

However, it doesn’t mean your business systems and IT infrastructure will not need to evolve. It’s almost guaranteed that your ERP solution will need to be extended or modified over time, in line with changing business requirements.

The only reason this wouldn’t be true is if you plan to stop growing (we doubt that’s the case!).

Let’s explore why optimising your enterprise solution after go-live is essential and how it contributes to better business outcomes.

Consider the total ERP system lifecycle to extract the greatest value

A common sentiment we share with anyone considering an ERP solution in their business is this: adopting new technology in of itself doesn’t automatically deliver value. Making the most of technology depends on whether systems are strategically designed, configured well, and embraced by a skilled and motivated workforce.

It’s also true to say that adopting technology does not instantly unlock value.

Embracing an integrated, digital approach to running your business may begin with introducing an enterprise solution from SAP, Sage or MYOB—but it doesn’t stop once the system goes live.

When the implementation project ends, the work to harness technology as a competitive driver must continue.

‘Post-go-live’ can’t be measured in weeks. It’s a period that could be up to 10 years—and includes every stage in an ERP solution’s lifecycle.

What kind of things will affect your ability to derive value from your system after implementation?

Adjusting to the new system

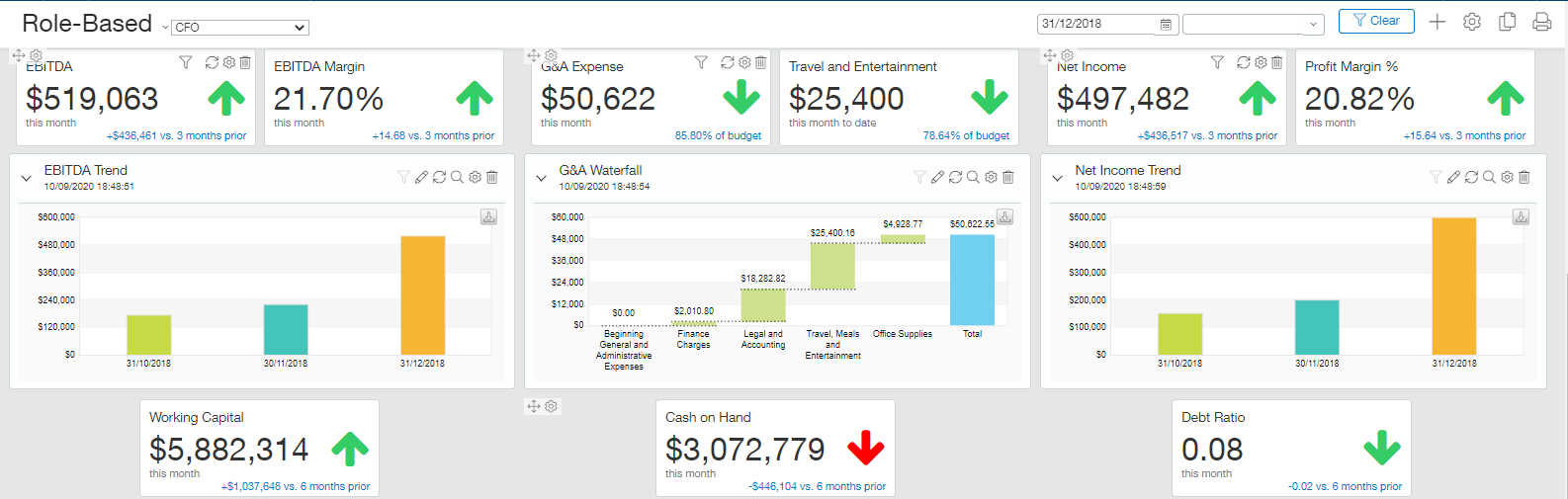

Initially, your team needs to adjust to the new software plus come to terms with systematic changes triggered by the new technology—new management styles, processes, services, and workflows. They’ll need great support to iron out issues, but as they practically use the system they might also need tweaks to how interfaces, reports, and dashboards function.

Maintaining and improving functionality

The software product doesn’t remain static. Innovative vendors that we support are continually putting money towards research and development and have networks of independent software developers that create complementary products. You need to plan ahead for how your business will effectively keep your ERP solution relevant and embrace other emerging technologies or enhancements that become available.

Evolving business systems to underpin growth

Longer-term, there is a raft of things that will impact your business, each of which may necessitate new or revamped ERP system functionality, configuration, and training—such as:

- Changing customer preferences, requiring new channels or customisation capabilities

- Increasing headcount, opening new offices or divisions, up-skilling staff changing roles

- Altered business structure, compliance/reporting outputs, or operational processes

- Entering new geographies with different currencies, tax and reporting requirements

- Establishing new products or services with different delivery models

- Mergers or acquiring new businesses in different industries

Regular improvement helps you achieve business goals

You want to be able to take advantage of new opportunities as they arise, so you need to cultivate an ERP solution that empowers your team, works as intended, and provides a platform for growth.

Fortunately, world-class ERP solutions like SAP Business One, MYOB Advanced and Sage X3 have been built to allow for flexibility, scale, and continuous improvement. They’re developed on cutting-edge architecture, can be deployed in the cloud, and are easily extendable through integrations, custom development, add-ons, and complementary solutions.

You can mould your ERP to match your business and customer needs—for example, by modifying existing modules to match a bespoke process, adding wireless barcode scanning capabilities, or integrating with an eCommerce website.

The benefits of regular maintenance and improvements to your ERP solution are many. It means you can:

- Always operate on up-to-date software versions with the most advanced features

- Limit downtime and maximise uptime, while also improving security and continuity

- Stay abreast of new capabilities and absorb these to improve business processes

- Quickly adapt to new technologies, business practices, and customer experience trends

- Pivot your strategy or quickly bring new businesses, products and services to market

Risks and costs increase if you fail to optimise your ERP solution

If you haven’t considered the best way to support and optimise your system going forward, you’re not only missing out on the benefits of a high-performing system (and team)— you’re setting yourself up for increased risk and costs.

You risk:

- Haphazard changes/additions that result in a complex, insecure, and unstable system

- Poorly maintained systems that become obsolete or too expensive to upgrade

- Systems that no longer empower your team to deliver on your business strategy

In other words, the investment you made in implementing a quality ERP solution could be squandered if you don’t support and improve the system over time. If you want to benefit from an ERP solution throughout the entire lifecycle of the application, you need to wisely invest in your system throughout its lifecycle.

In turn, investing in post-implementation support and optimisation projects allows you to better control total lifecycle costs. How’s that?

If you neglect your ERP for years, your operation will become less efficient (and more costly), and you’re likely to be ‘surprised’ by an expensive bill to bring it back to a usable level, or throw good money after bad by switching systems again.

On the other hand, regular maintenance and enhancement ensure your system is always performing at its best which extends the usefulness of the system, help you get the best out of your talent, and run a more efficient and cost-effective business.

We can help you improve your systems to keep pace with change

Post-go-live optimisation and improvement can’t be left to chance. Maintenance and optimisation must be planned and enacted by experienced and technically proficient people or providers.

Leverage Technologies are one of Australia’s leading software consultancies because we build collaborative relationships with our customers, and focus on helping your business be successful over the long-term. ERP system optimisation is a key service we provide.

We’re no fly-by-night business—we’ve been around since 2005, helping SMEs Australia-wide to choose, implement, support, maintain and optimise the ideal ERP system for their needs.

Talk to us today about working together to support or enhance your ERP solution.